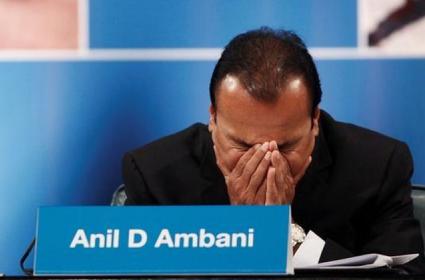

The Rise And Fall Of Anil Ambani

Anil Ambani has had a Debt saddled business empire and he has spent years trying to fend off creditors and suing critics. But now, it finally is a defining moment as his race to pay off debts would be met by jail time if he does not make the payments on time.

The Reliance Group’s phone unit has disobeyed a ruling to pay an amount of over $77 million to a local subsidiary of supplier Ericson AB, said the Indian Supreme Court. To top it all off he has been asked to pay the due in four weeks to avoid being sent to jail. Anil Ambani’s group has agreed to comply with the orders and make the payment before the deadline.

For a man listed in the Forbes magazine in 2008 as the world’s sixth wealthiest person, this will be an extraordinary fall. The court's decision has come upon Ambani after a tough year as parts of his empire has had heavy losses owing to the tough competition as the market for telecommunication has become only more brutal. His story also offers insights into how far India has come in cracking down on overdue borrowers and curbing the financial impunity of its richest citizens.

“He has reached the final weeks of the battle,” said Arun Kejriwal, director at KRIS, a Mumbai-based investment advisory firm, to a leading media house. Ambani can put up a fight with Ericsson and other creditors but can't do the same with the nation’s top court.

After a high profile dispute with brother Mukesh over the conglomerate built by their father, who died in 2002 without a will, Anil Ambani took ownership of the telecom business. Before the father’s death, both the brothers worked as executives at their father's company. Three years after the father dies, the empire was divided in two giving both the brothers a spot among India’s wealthiest businessmen

While Mukesh got the Flagship Oil-refining and petrochemicals, Anil got newer businesses such as power generation, financial services, and telecom business. Anil had borrowed heavily to build a credible conglomerate and diversify his business, only so that he could match up to his brother’s returns with the refining firm Reliance Industries Ltd

A non-compete clause had kept Mukesh out of the telecom business until it was scrapped in 2010. And then came the very famous Reliance Jio that revolutionized mobile phone packages, by offering unlimited internet and calls. We all know how well that took off. Meanwhile, his other businesses were also seeing a dip, and it was not only the telecom business. Shares of Reliance Naval & Engineering Ltd.,

and Electricity generator Reliance Power Ltd., had dropped drastically with the company posting out only losses.

RCom has said it requested urgent approval from its lenders to release about 2.6 billion rupees ($37 million) received from income tax refunds, which are in its bank account, directly to Ericsson. A sum of 1.2 billion rupees has already been deposited with the Supreme Court and the company is confident it will be able to raise the balance of about Rs 2 billion in time, it said.

Meanwhile, Anil’s Reliance Capital Ltd. has sought to raise funds by inviting Nippon Life Insurance Co. to take full control of their joint venture Reliance Nippon Life Asset Management, according to a stock exchange statement. "This is the easiest and fastest way to resolve the looming crisis," Kejriwal said.

Also Read: Ambani Offers Artificial Intelligence At Rs 100 Per Month